|

| Name |

kanchanaburi Special Economic Zone |

| Location |

Open in Google Map |

| Province |

kanjanaburi |

| Country |

Thailand |

| Photos |

|

| Overview of the EZ |

Area of Kanchanaburi Province has the potential to be the economic center of the Western region. Linking the Dawei Special Economic Zone (Myanmar) to the Indian Ocean and the Eastern Seaboard of Thailand to the Pacific Ocean.

Distance to Bangkok 129 kilometers and Laem Chabang deep sea port Production target Including the agro-food processing industry And beverages, chemicals, and motor vehicles. In the area, there is an opportunity to develop into a value chain based on the advantage of Distance to Bangkok 129 kilometers and Laem Chabang deep sea port Production target Including the agro-food processing industry And beverages, chemicals, and motor vehicles in the areathere is an opportunity to develop the value chain by using the advantage of accessing both sides of the sea gate. Currently, the border trade value is approximately 112,458 million baht and currently has Important areas in the project are the motorway route connection (Bang Yai) and Ban Phu Nam Ron checkpoint. Customs Checkpoint Development Project at Ban Phu Nam Ron Permanent Border And the double track railway structure (Laem Chabang-Ban Phu Nam Ron-Dawei)

|

| Location Advantage |

This kanchanaburi province can be developed into an economic base because of its location on the link between the Dawai (Tavoy) Special Economic Zone in Myanmar and the Eastern Seaboard; it can therefore transport goods to the sea—through the Dawai Seaport— to countries on the Indian Ocean, the Middle East and Europe) —and Laem Chabang Seaport— to the Pacific countries.There is a plan to build a special State Highway to connect Bang Yai (Nonthaburi) to the border area in Kanchanaburi Province to facilitate communication between the Special Economic Zone in Kanchanaburi Province and Bangkok and its vicinity. The processed agricultural industry, food and beverages industry, chemical products industry and motor vehicles industry in the area have the chance to develop a chain of value, depending on the advantage of the provinces being gateways to both oceans and to labour from the neighbouring countries.The connection of the railway between Laem Chabang Seaport and the deep sea Dawai (Tavoy) Seaport,

|

| Website |

http://www.kanchanaburi.go.th |

| Year of Establishment |

2016 |

| Total Area of the Zone |

260.97 square kilometres (162,943 Rai) including |

| Zone and Area (repetition) |

General Zone

|

| Land Leasing Cost per Acre |

Annual rental rate24,000 - 40,000 baht / rai / year Land rental arrangement fees The same rate is between 160,000 - 300,000 baht and can be paid once or for a 5 year installment (payment for years 6-10). |

| Name of Developer |

Policy Committee of Special Economic Development Zone |

| Management Structure |

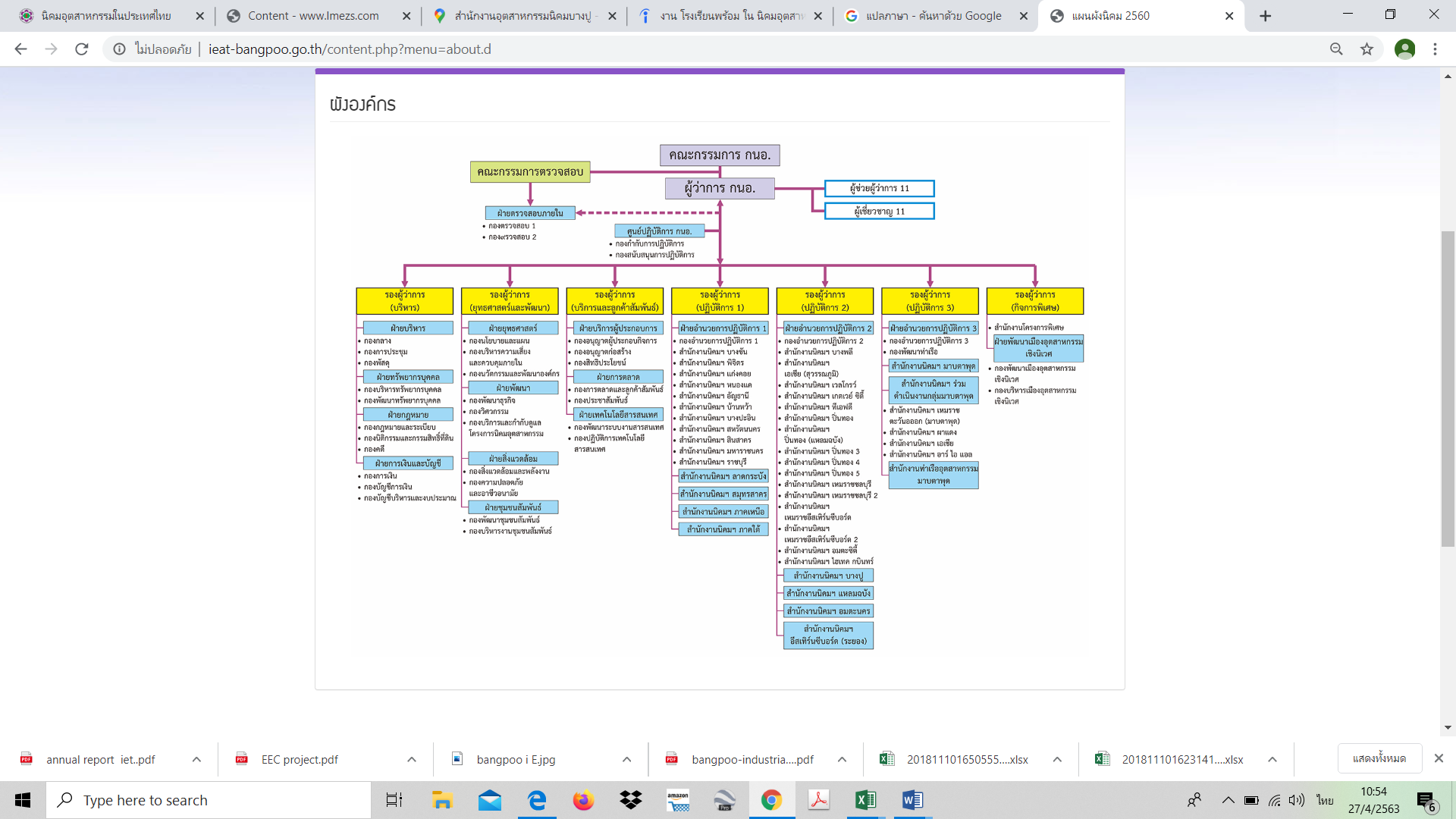

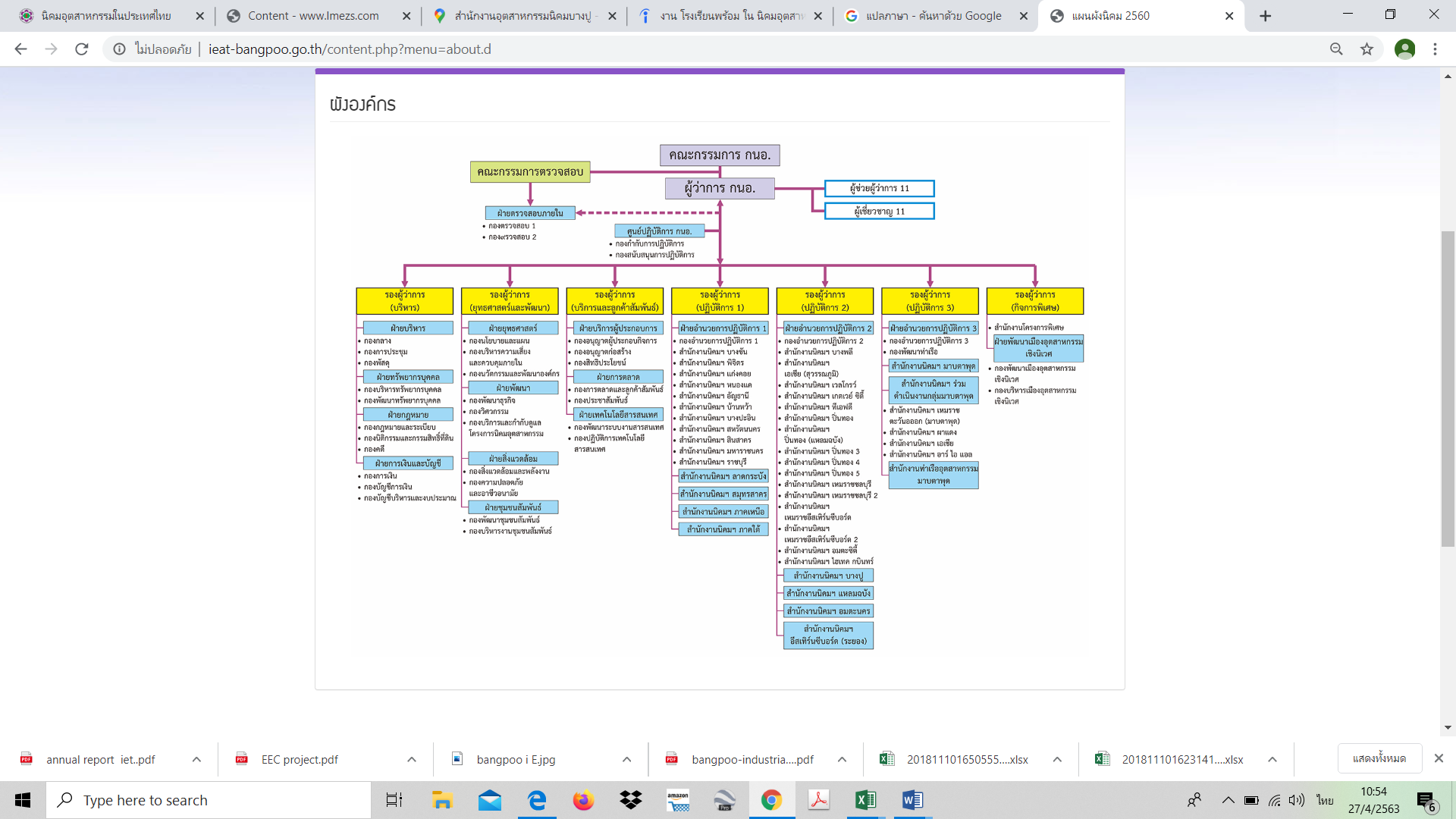

ฺBoard

|

| |

|

| Incentives (Tax and Non-Tax) |

Privilege

The Eastern Economic Corridor (EEC) Development Plan under scheme of Thailand 4.0 aiming to revitalise and enhancing of the well-known Eastern Seaboard Development Program that had supported Thailand as a powerhouse for industrial production in Thailand for over 30 years.

Under this initiative, the Eastern Economic Corridor Office of Thailand (the EECO) has been assigned to drive the country's investment in up-lifting innovation and advanced technology for the future generation. The EEC Development Plan will lead a significant development and transformation of Thailand's investment in physical and social infrastructure in the area.

The EEC project will, initially, be focused in 3 eastern provinces namely Chachoengsao, Chonburi and Rayong. Regarding this, the EEC Policy committee is the primary Royal Thai Government collective force chaired by Prime Minister of Thailand.

BOARD OF INVESMENT (BOI)

The Board of Investment's (BOI) invest promotion measure in the Eastern Economic Corridor (EEC) is especially designed to boost targeted investment activities in designated areas in three provinces: Chachoengsao, Chonburi and Rayong. Private sector is encouraged through this measure to involve in human resources development in the business.

The development of the EEC Area is one of the government's policies to drive Thailand towards the new era of Thailand 4.0. Investments in targeted industries in the aforementioned areas are entitled to higher incentives.

INDUSTRIAL ESTATE AUTHORITY OF THAILAND (IEAT)

For the industrial estate to serve as the manufacturing base that contributes to industrial operators’ competitiveness; aside from the infrastructure system, facilities, and the management system; there is the need to put in place privileges that help industrial operators with business facilitation – equipping them with the ability of choosing to trade in their market of choice, domestic or export, based on current competition conditions.

Non-Tax Privileges for investment in bothGIZ and I-EA-T Free Zone

- The right to own land in an industrial estate

- The right to bring in foreign skilled workers, with visa and work permit facilitation

- The right to bring in foreign skilled workers’ spouses and dependents, with visa facilitation

- The right to remit money abroad

- The right to receive additional privileges from Thailand’s Board of Investment (BOI) when applying for investment promotion

Tax Privileges for investment in I-EA-T Free Zone

- The right to receive non-tax privileges, similar to investment in the GIZ

- The right to receive additional tax privileges

- The right to receive exemptions of import duty; value-added tax (VAT); as well as excise tax on machinery, equipment, raw materials and supplies used in production

- The right to receive exemptions of export duty; value-added tax (VAT); as well as excise tax on imported materials for use in production or for commercial operation

- The right to receive exemptions of export duty; value-added tax (VAT); as well as excise tax on raw materials, products and by-products

|

| Total Number of Investors |

2 |

| Investor Nationalities |

Thai, ustralia

|

| Items Imported in the Zone |

| Item |

Volume |

| Natural gas |

48,241,633,653.70 Baht |

| cow & buffalo |

27,150,000. Baht |

| Antimony ore |

18,457298.65 Baht |

| Lignite coal |

9,304756.12 Baht |

| Bamboo trunk |

1,536897.33 Baht |

| Unsorted sesame seeds |

1,345,680.00 Baht |

| Sawdust |

920,000 Baht |

| Furniture and artifacts made of wood |

714,6000 Baht |

| Shallot |

626,600 Baht |

| Seafood |

422,600.00 Baht |

|

| Items Exported from the Zone |

| Item |

Volume |

| Diesel fuel |

ุถมภ-ุมถึคใค/ |

| beer |

218,139,209.61 |

| Dried betel nut |

35,110,217.89 |

| Dietary supplement products and milk |

27,709,213.00 |

| Unleaded gasoline |

22,535,235.64 |

| Seasoning |

17,206527.00 |

| Palm oil |

10,033,540 |

| Agricultural machine |

8,745,650 |

| Instant coffee |

7,139,376 |

| Instant noodles |

ุ6,373,792 |

|

| EZ Authority and Contact Address |

TheOffice of the Special Economic Zone in Kanchanaburi Province Kanchanaburi Provincial Government House, Saeng-Xuto Road, Pak Phraek Sub-district, Mueang District, Kanchanaburi Province 71000 Telephone 034-512-399, Fax 034-512-208 Email: kanchanaburi-sez@moi.go.th

|

| Total number of companies in the Zone |

2 |

|